HAMMER PATTERN

When we want to know when the price starts to reverse direction and how to identify a changing trend, the hammer candlestick is one of the important patterns that can be used to anticipate a price reversal.

In this article, we will review and discuss the hammer pattern for forex trading.

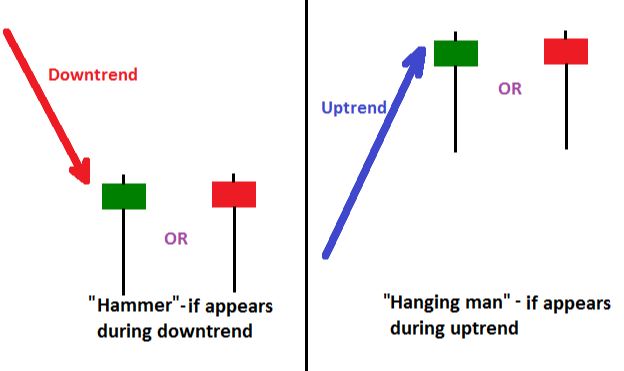

Hammer is a bullish reversal pattern that is formed in a downtrend. When the price is falling, the hammer pattern indicates the lower limit is near and the price is going up again. The hammer pattern is characterized by a single candle at the lower end of a downtrend, with a very long lower wick and a very short upper wick, in some cases none at all.

Loaded with hammer patterns

Occurs at the end of a downtrend.

The length of the tail is at least twice the size of the body candle.

There is no provision regarding the color of the candle, but if the hammer candle has a bullish color, then this will reflect the strength of the reversal better.

The length of the tail is at least twice the size of the body candle.

There is no provision regarding the color of the candle, but if the hammer candle has a bullish color, then this will reflect the strength of the reversal better.

Use in Trading

Hammer patterns can be found on various charts and time frames. The example D1 chart of AUD/USD below reflects the appearance of a hammer candle that signals a price reversal.

Thus, the price decline from the chart above was ended by the formation of a hammer candle that occurred at the lower end of the downtrend. Long positions opened above the open hammer level will certainly bring great profits in the long term.

Hammer Confirm

The signal strength of a hammer candle generally depends on its position. Many traders combine hammer with support and resistance analysis. Indicators such as Fibonacci lines, pivot points, and psychological levels, become the focus of traders who intend to confirm hammer candle signals.

An ideal example, if the tail of the hammer is able to break through the support level but the body closes above that limit, the trader can take the lowest level of the hammer (at the end of the tail) as a stop loss. Because this condition reflects the newly formed buy sentiment, then such an action is quite reasonable to apply.

An ideal example, if the tail of the hammer is able to break through the support level but the body closes above that limit, the trader can take the lowest level of the hammer (at the end of the tail) as a stop loss. Because this condition reflects the newly formed buy sentiment, then such an action is quite reasonable to apply.

click here to read hanging man

Tags

CANDLE