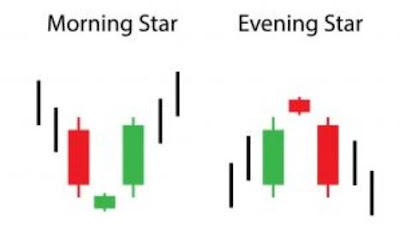

Morning Star & Evening Star

Difference From Morning Star & Evening Star

Know The Characteristics Of The Morning Star & Evening Star

For traders with candlestick formations, the Morning Star

pattern and the Evening Star pattern can be analogized as a green light to hunt

for profits. Is that right?

There's no need to rush. These patterns are quite popular because their appearance is usually followed by a longer correction than other patterns.

The morning star is a bullish indication, while the evening star is a bearish indication.

Morning Star Pattern Features

You can recognize a morning star if it has the following

characteristics:

The first candlestick is a bearish candlestick, which is part of a downtrend.

The second candlestick is a candlestick that has a smaller body, it can be a bullish or bearish candlestick. This indicates that there is “hesitancy” in the market.

The third candlestick is a longer bullish candlestick than the second candlestick. The length does not need to be the same as the first candlestick, but the close price position must exceed half of the body of the first candlestick. This is confirmation of the formation of the morning star pattern.

Evening Star Pattern Features

How about the Evening Star? What are the characteristics of this pattern?

The first candlestick is a bullish candlestick, which is part of an uptrend.

The second candlestick is a candlestick that has a smaller body, bullish or bearish is not important.

The third candlestick is a bearish candlestick that is longer than the second candlestick. The length does not need to be the same as the first candlestick, but the close price position must exceed half of the body of the first candlestick. This is confirmation of the formation of the evening star pattern.

There are times when these two candlesticks become a doji, so the name of the pattern can be modified to Morning Doji Star or Evening Doji Star. It will make you easier as you trade in binary or forex

Click here to learn how to use morning star and evening star in forex